Retirement, Health Care and Disability

Superannuation Key Summary

- Total Superannuation Assets:

- $3.9 trillion at the end of the March 2024 quarter

- Employer Contributions:

- $133.3 billion for the year ending March 2024, 12.4% increase compared to the previous year

- Influenced by Super Guarantee (SG) rate increase to 11% from 1 July 2023, employment growth, and higher wage inflation

- Member Contributions:

- $43.7 billion for the year ending March 2024, 8.2% increase compared to the previous year

- Rate of Return:

- 4.9% for the March 2024 quarter

- 10.9% for the year ending March 2024

- Five-year average annualised ROR: 6.4%

Retirement and Social Security

Retirement and Social Security

- Insurance provides financial security in the event of death, injury, or damage to property.

- Major risks: longevity risk, health deterioration, unemployment.

- Social security benefits: income for retirement, unemployment, and other benefits.

- Financing: taxation system, specific levies, or overall tax revenue.

Example 10.1: How are health costs financed in Australia?

- Medicare provides coverage for hospital and medical treatment.

- Financing: partly from a direct Medicare levy, mostly from taxation revenue.

Longevity Risk and Dependency Ratio

- Longevity risk: individuals live longer than average, requiring more resources post-retirement.

- Dependency ratio: increasing due to improved mortality and lower fertility rates.

- Example: OECD countries’ dependency ratios expected to increase by 40% over the next 40 years.

Retirement Income and Superannuation

Retirement Income Arrangements

Types of retirement income arrangements:

- By provider: Publicly or Privately provided

- Publicly provided: Government provided benefits, funded from general revenue or social security taxes (generally publicly managed)

- Publicly mandated: Government regulation requires compulsory private provision (generally privately managed)

- By funding method: PAYG (pay-as-you-go) or Funded

- PAYG: Benefits are paid out of current income (e.g. government general revenue or specific social security or payroll taxes, firms’ profits)

- Funded: Accumulation of assets to provide for future liabilities

- By benefit design: DB (defined benefit) or DC (defined contribution)

Retirement Income in Australia

Australia’s ‘three-pillar’ approach:

- Public Age Pension

- Compulsory Superannuation (Superannuation Guarantee)

- Voluntary Retirement Savings (Superannuation and other)

Publicly provided PAYG pension

- Eligibility:

- Qualifying age: 67

- Residence requirements: Australian resident for 10 years

- Means-tested: Subject to income and assets tests

- Coverage:

- Around 75% of people of Age Pension eligibility age receive Age Pension.

- Benefits:

- Payments indexed 6 monthly.

- Subject to income and assets tests.

- Full pension rates (2024): $26,535.6 (single)

- The full Age Pension allows only a modest lifestyle for retiree homeowners in good health!

Superannuation

Publicly mandated privately managed occupational pension system (predominantly DC)

- Mandatory employer contribution - 11.5% of an employee’s earnings (set to increase to 12%)

- Preserved benefits - generally superannuation can only be accessed when you reach a specific age (60)

- Concessionally taxed - concessional taxation of contributions fund income (earnings) and benefits

- Tax-free benefit payments for over 60

- Final benefits depend on various factors such as contributions, investment returns, fees, etc.

Defined Benefit Funds

Feature: Retirement benefit is defined (by a pre-determined formula based on factors e.g. years of service, salary etc.)

Example 10.4: Main form of retirement benefit from a DB fund.

- A common benefit for a superannuation fund paying a defined benefit would be a pension of:

where ( n ) is the number of years of membership of the fund and FAS is the average salary over the (final) three years prior to retirement.

DB Benefits Example

Example:

- A member with 40 years of service and salaries in the three years prior to retirement of $80,000, $85,000, and $75,000 would receive a pension of:

- A member with 15 years of service would receive:

Defined Benefit Fund Mechanics

- Trustees ensure the fund can pay defined benefits by requiring the employer or sponsor to contribute sufficient money.

- Contributions are determined by the fund actuary.

- Contributions and investment earnings must be sufficient to pay benefits under the Trust Deed.

- Benefits do not depend directly on the fund’s investment returns.

- Risk of low investment earnings is met by the employer, who may make higher contributions in such cases.

- In theory, benefits may be reduced, but this is unlikely to be allowed by the Trustees.

Defined Contribution Funds

Feature: Contribution is defined (by % of salary), retirement benefit depends on investment performance etc.

- The benefit payable on retirement is not defined.

- Determined by the amount that the contributions accumulate to, allowing for investment earnings, less charges for administration costs and the cost of death and disability cover.

- Usually provides life insurance charged against contributions.

- Governments usually provide favorable taxation treatment for superannuation savings (tax deferral).

Taxation of Superannuation Funds in Australia

Example 10.5: How does the Australian government tax superannuation funds at present?

Solution:

- Contributions into superannuation funds are taxed at 15% as income of the fund.

- Individuals are taxed on contributions above a specified level as income.

- The investment income of the funds is taxed at 15%.

- Benefits are taxed when they are paid at a reduced rate, giving credit for the 15% tax already paid.

- Governments usually limit the amount of retirement benefits that receive favorable taxation treatment due to this favorable taxation treatment.

Health Care and Disability

Health Care and Disability

Example 10.7: How is health care financed in Australia?

- Public health care for hospital and medical treatment is available and partly paid for by a Medicare levy based on taxable income.

- Private hospital treatment and additional health benefits are available at full cost to individuals without private insurance.

- Health insurance is available for private hospital and other health benefits.

- Community rating is used for private health insurance in Australia, where everyone pays the same rate regardless of risk.

Long-Term Care and Disability Income Insurance

Long-Term Care:

- Insurance companies in some countries have introduced policies providing income benefits for home and nursing home care.

- These policies pay benefits based on the number of Activities of Daily Living (ADLs) that the individual is unable to perform.

Disability Income Insurance:

- During an individual’s working life, disability or sickness can lead to a substantial loss of income.

- Insurance companies sell disability income insurance to cover this risk.

- Typical policies pay up to 75% of an individual’s income if they are disabled and unable to perform any occupation.

Lifecycle Model

Lifecycle Framework

The central problem: How can I best spread the income from the economically productive part of my life over my whole life?

Think of a lifetime as being divided into three (economic) stages:

- Childhood/Young adulthood: the growing up and getting education stage; pre-economic period of dependence and skill acquisition

- Working life: the wage-earning stage; period of economic accumulation

- Retirement: withdrawing from active working life; period of decumulation

Simple Lifecycle Model

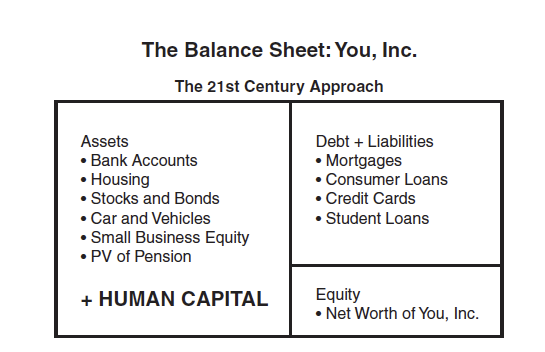

The Lifecycle of ‘You, Inc’.

Lifetime resource management decisions start with analyzing resources:

- Starts as a subsidiary of Parents, Inc.

- Merger opportunities: Marriage

- Acquiring new headquarters: Home purchase

- Key decisions: Education, career, investments

Consider the following:

- What you own: Assets

- What you owe: Liabilities

- What is your Net Worth? How does it change over time?

The Concept of Human Capital

- Human capital refers to your knowledge, skills, abilities, and social and personality attributes that enable you to generate labor income.

- Human capital can be measured through estimating the value of all your future earnings.

- Human Capital = Present value of expected future earnings.

- Where ( S ) is the expected salary

- ( g ) is the salary growth rate

- ( r ) is the interest rate

- ( n ) is the number of working years

Human Capital Example

Example:

- John graduates from university at age 22 and earns a starting salary of $50,000.

- John’s earnings grow by 3% per annum until retirement at age 65.

- Assume the interest rate of 3%.

- Ignoring taxes, what is the present value of his expected future earnings?

Calculation:

\[\text{PV} = 50,000 \sum_{i=1}^{43} \frac{(1.03)^{i-1}}{(1.03)^i} = \$2.09 \text{ million}\]